return on equity

Maximizing Returns: A Guide to Evaluating Your Real Estate Investment

Real estate investing offers an array of avenues for returns, and as an investor, identifying the most lucrative metric can significantly impact your wealth-building journey. While monthly cash flow and cash-on-cash returns have their merits, many seasoned investors often emphasize the importance of Return on Equity (ROE). In this guide, we’ll delve into understanding ROE, how to calculate it, and why it holds a critical place in a sophisticated investor’s toolkit.

Understanding Return on Equity (ROE)

Return on Equity is a key metric in real estate investing, representing the rate of return derived from a property investment. The calculation involves dividing the profit (cash flow) by the Total Deployable Equity, accounting for potential selling commissions if the property were to be sold.

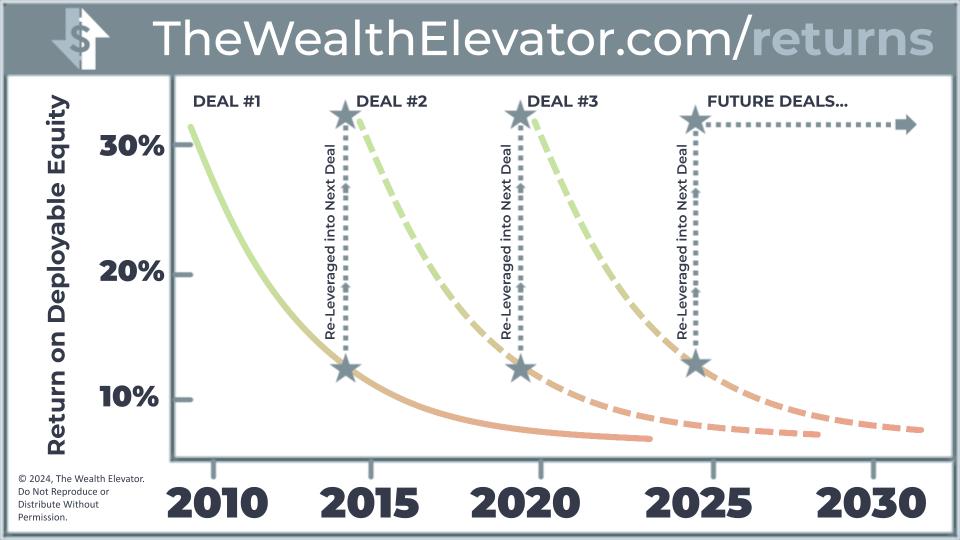

Sophisticated investors, like Lane and others in the field, closely monitor ROE. The reason is clear—evaluating assets is crucial for identifying underperforming investments and making strategic adjustments to the portfolio. ROE becomes a guiding factor in deciding which assets to sell, refinance, or leverage using a Home Equity Line of Credit (HELOC).

Calculating ROE

To calculate ROE, the formula is simple:

Investors can download a dedicated worksheet to streamline the ROE calculation process.

Importance of ROE in Portfolio Management

ROE serves as a compass for investors to determine the highest and best use for their capital. While the common adage “buy and never sell” prevails, a more nuanced approach involves buying and evaluating ROE prudently. This approach allows investors to achieve high returns and ensures safer capital preservation.

Comparing ROE with Other Metrics

Real estate investors often use various metrics to assess investment quality, including:

- Cash on Cash (COC): Evaluates pre-tax year-end cash flow in relation to the original investment.

- Return on Investment (ROI): Assesses overall return on the investment.

- ROE: Monitors the return derived from equity in the property.

Sophisticated investors re-leverage when ROE decreases, using COC to determine the optimal use of liquidity entering an investment. While COC is relevant during the initial stages, ROE becomes crucial once the investment is owned.

Annualized Return on Investment (Annualized Return)

Real estate investments often require time to mature and stabilize. Annualized return factors in the cash flow returns received during the property’s holding period and accounts for profits from a property’s sale or refinancing at the exit.

Annualized Return = Total Cash Flow Returns/Number of Years

This metric aids in comparing different investment plans with similar ownership durations.

Managing the Illiquidity of Real Estate

One downside of real estate investing is its illiquid nature. However, as an investor holds onto properties, equity accumulates through mortgage paydown, general market appreciation, and forced appreciation from property improvements.

When evaluating ROE over time, it becomes evident that as property values increase, the return on equity may decrease unless the property continues to generate higher cash flow. Sophisticated investors, therefore, use a threshold of 10-15% ROE and consider strategic actions, such as cash-out refinancing or 1031 exchanges, when returns dip below this range.

Taking Action: Unleashing Lazy Money

Investors are encouraged to take proactive steps in managing their portfolio:

- Evaluate Your Portfolio: Use a spreadsheet to analyze properties based on metrics like ROE and Cash on Cash Return.

- Identify Lazy Money: Look for investments with declining ROE, signaling underutilized equity.

- Optimize Your Portfolio: Trade in “lazy money” for better-performing investments, using prudent leverage to maximize returns.

Sophistication vs. Simplicity

While the journey from higher returns to scalable, passive investments is inevitable, understanding and leveraging metrics like ROE distinguish sophisticated investors from those relying solely on cash flow. Real estate investing is not just about making money; it’s about making money work smarter and more efficiently.

In conclusion, ROE is a powerful tool for investors, providing insights into the performance of their real estate assets. As you navigate the complexities of real estate investing, remember that maximizing returns involves not only acquiring properties but also strategically managing and optimizing your portfolio over time.

Rental Property Equity Check

Rental Property Equity Check

🎥 https://youtu.be/hFK20F_8-S0

Objective: Reassess the performance and opportunity cost of your current portfolio.

Portfolio Snapshot (Quick Math)

Portfolio Snapshot (Quick Math)

1. Total number of rental properties:

2. Approximate equity (total value minus debt):

$___

3. Total annual cashflow (net after expenses):

$___

4. What % return are you earning on your equity?

(Net Annual Cashflow ÷ Total Equity) × 100

= ___%

If you’re earning less than 4–5% on equity, you may have a “lazy asset.”

Then vs. Now

Then vs. Now

5. When you started investing, what was your typical LTV (loan-to-value)?

___%

6. What is your current average LTV?

___%

7. What made rental property investing attractive to you back then?

☐ Leverage

☐ Appreciation potential

☐ Depreciation tax shelter

☐ Cashflow

☐ Control

☐ Other: _________

Has Anything Changed?

Has Anything Changed?

8. What’s different about your portfolio today?

☐ Less leverage

☐ Slower appreciation

☐ Repairs and capex rising

☐ Rent increases are tapering

☐ You’re more passive now

☐ You want better tax strategy

☐ You’re considering other assets (syndications, funds, etc.)

Opportunity Cost Check

Opportunity Cost Check

9. If you sold today, what’s your best estimate of:

Net equity unlocked (after tax + fees): $___

Estimated return if reinvested passively at 8–10%: $___ annually

10. What’s holding you back from re-deploying your equity?

☐ Taxes (capital gains, depreciation recapture)

☐ Uncertainty about what to do next

☐ Emotional attachment

☐ Fear of passive investing

☐ Lack of trusted opportunities

☐ Other: __________

Action Steps (Write 1–2)

Action Steps (Write 1–2)

What would help you evaluate next steps?

Example: “Model 1031 vs. cash-out vs. sale” or “Talk to a CPA about passive loss offset”

- Do the eCourse 8 Ways to Eliminate Capital Gains for Accredited Investors

begin your journey to financial freedom!

My name is Lane Kawaoka, and I hope my blog/podcast will help families realize the powerful wealth-building effects of real estate so they can spend their time on more important, instead of working long hours and worrying about their financial troubles. There are a lot of successful families with good jobs (teachers / engineers / programmers / finance) yet they struggle to make ends meet financially. It is their kiddos who ultimately get the short end of the stick. Being a Latch-Key Child growing up, both my parents had to work and I was left home alone after school to fiddle with my thumbs.

With Real Estate you are able to grow your wealth exponentially faster than the conventional 401K’s and stock investing, therefore you are able to escape the dogma of working 50+ hour weeks at a job that is unfulfilling. And if you are one of the lucky ones who happen to do what you enjoy… well good for you 😛

Money is not everything but it is important because it gives you the freedom to live life on your terms.

Annoyed by the bogus real estate education programs out there (that take money from people who don’t have it in the first place), I set out to make this free website to help other hard-working professionals, the shrinking middle-class. I hope to dispel the Wall-Street dogma of traditional wealth-building, and offer an alternative to “garbage” investments in the 401K/mutual funds that only make the insiders rich. We help the hard-working middle-class build real asset portfolios, by providing free investing education, podcasts, and networking, plus access to investment opportunities not offered to the general public.

“The true meaning of wealth is having the freedom to do what you want, when you want, and with whom you want.

Building cash flow via real estate is the simple part. The difficult part occurs after you are free financially to find your calling and fulfillment.

But that’s a great problem to have ;)”

excerpt from The One Thing That Changed Everything