This content is a sample of our comprehensive Infinite Banking eCourse, available for FREE to club members.

Is It Beneficial or Not?

In the realm of financial strategies, one that often stands out for individuals with a substantial net worth is Infinite Banking. This approach revolves around using whole life insurance as a tool for building wealth, liquidity, and protection. In this article, we will delve into the key concepts of Infinite Banking, its strategic use, and how it can be tailored to individual financial goals.

Investing in Good Deals:

At the core of the Infinite Banking concept is the idea of investing in good deals. Unlike conventional retail investments with high fees, Infinite Banking encourages individuals to focus on lucrative opportunities that provide not only good returns but also passive losses (PALS). Passive losses can be strategically used to optimize tax payments, either through real estate professional status or offsetting passive income.

The Tax Advantage:

Reducing tax liabilities is a central element of the Infinite Banking strategy. By strategically using passive losses, individuals can pay fewer taxes, resulting in increased funds available for investment. This creates a cyclical pattern, allowing for further investment and potential contributions to an Infinite Banking policy.

Infinite Banking as an End Game Strategy:

Infinite Banking is often considered an end game strategy, more suitable for individuals with a net worth of half a million dollars or more. The customization and utilization of whole life insurance policies can be complex, making it more suitable for those well-versed in financial strategies.

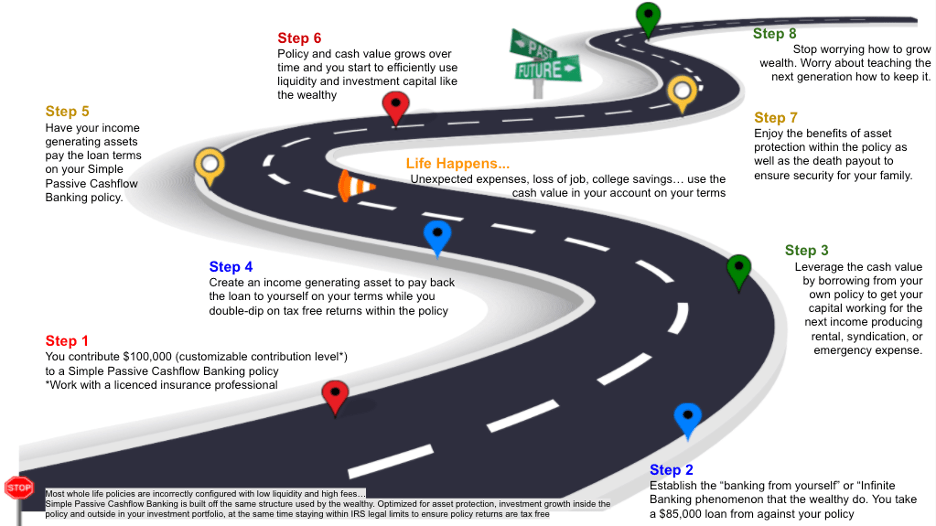

Breakdown of the Infinite Banking Process:

During an Infinite Banking session, participants are typically divided into groups based on their familiarity with the concept. Experienced individuals (highlighted in yellow) act as leaders, guiding those who are newer to the strategy. This collaborative approach allows for intermediate to expert-level discussions within each group.

Understanding the Whole Life Insurance Policy:

In the context of Infinite Banking, whole life insurance is not the conventional policy sold by retail agents. It involves customizing the policy in three dimensions: liquidity, returns, and insurance death payout. The aim is to maximize liquidity while sacrificing some returns and insurance benefits. The tax-free growth within the policy and asset protection are key perks of this approach.

Choosing the Right Provider:

Selecting the right insurance company is crucial for Infinite Banking. It is recommended to opt for reputable, AAA-rated insurance providers such as Northwestern Mutual or Ameritas. These companies offer stability and security, essential for the long-term success of Infinite Banking.

Understanding Fees and Front-Loading:

Fees associated with Infinite Banking policies are a critical consideration. While front-loaded fees may seem significant initially, they tend to decrease over time. It is important to analyze the fee structure and evaluate the long-term benefits of the policy.

Infinite Banking in Action:

Participants in an Infinite Banking strategy can utilize their policies as a financial tool. For example, taking loans from the cash value to invest in real estate deals provides a tax-free growth opportunity. The flexibility to repay loans and reinvest in the policy creates a dynamic financial approach.

Infinite Banking, when properly understood and executed, can be a powerful strategy for wealth-building, tax optimization, and asset protection. While it may be more suitable for individuals with a higher net worth, the principles can be adapted to various financial situations. It’s essential to work with experienced professionals and continuously evaluate the strategy’s effectiveness based on individual financial goals and market conditions.

Are you aware that there is more to it than simply saving your money in the bank?

Banking from yourself (with life insurance as the mechanism) allows cash flow investors to augment the investing they already are or will be doing.

- Grow your money Tax-Free (Use the same loophole that the politicians put in the tax-code for themselves to use personally).

- Asset protection – litigation and creditor-protected.

- Your money grows in two places at the same time. In this secure policy and your higher yield investments (syndications + rentals).

- Better than 401Ks, Roth’s, 529s because no government regulated restrictions on how you can use this money.

Infinite Banking Highlights

Growth

Expect to net a 5-6% return. This comes from a gross interest credit of 4% guaranteed, along with a long history of paying dividends that are currently paying an additional 2-3%.

Loan Provision

Policies carry a unique guaranteed loan provision that makes it possible to use core wealth-building principles such as leverage, velocity, and cash flow to maximize the way your money works for you. Because money on a loan comes from the general account of the insurance company, NOT directly from the cash value, we can create value in more than one place at the same time.

(Safety

100% safe from market volatility and guaranteed to grow. These mutual life insurance companies we represent have been paying dividends for more than 150 years. This includes times like the Great Depression, World Wars, and a myriad of different market cycles.

Liquidity

Unlike having money in a qualified plan such as an IRA or 401K, money is accessible at any time without the worry of a 10% IRS tax penalty. Liquidity can be the difference between capturing an opportunity or letting it slip away.

Tax Free Growth

Money grows and comes out on a tax-free basis, and unlike a Roth IRA, there are no contribution or income limits.

Death Benefit

Since we are using dividend-paying whole life insurance, there’s always a 100% tax-free death benefit. Although we’re primarily focused on the living benefits and cash growth, this is a significant benefit. It’s insurance we don’t have to pay for in any other way.

Long-term Care Coverage

Provides an efficient way to plan for the ever-increasing expenses associated with long-term care. By utilizing the accelerated death benefit rider (no additional cost), you can utilize a portion of the tax-free death benefit to cover long-term care costs.

For a FREE Policy Illustration, email:

bank@thewealthelevator.com

Additional FAQ's

It took me a long time to understand myself and it really helps to have a few people around you to talk you through it (other than the insurance salesperson).

You just want to make sure you are customizing whole life insurance for the three “levers”.

1) Liquidity – Max

2) Interest rate – minimize

3) Death pay out – minimize

The rest really has to do with how much your sales guy is taking in commissions.

Slow down buddy it is cool that you are making money two places, tax free (because it’s life insurance), and provides litigation protection but don’t forget you are paying a price for this. There are heavy fees in the beginning (30% of what you load in) which does decrease as the years go by and goes down to around 10% by year 3.

DO NOT FORGET THAT YOU LOST the opportunity cost of the money paid as fees. None of those fancy (confusing spreadsheets) include this.

An IBC is not really for a guy under 200-400k net worth because that person needs to invest every free dollar they can and cannot afford to pay the fees for the benefits of an IBC plan. It’s more for people who are loose or inefficient with their liquidity. Or in other words, have 30-100k+ of cash hanging around not doing anything frequently.

For me I am always broke when you look at my bank account, because I suffer from severe liquidity anxiety (don’t want any cash making less than 10%). Often I will work with clients who have 100k’s of money just sitting around so we use IBC as a means to slow them down so they can become a Sophisticated investor and make a bit of yield in an IBC.

Mainstream financial advice can be frustrating! In the world of retail investments, the baseline is 4-5%, with 12-15% being attainable without excessive risk. Insurance companies, which generate income through insurance products and investments are likened to syndication companies, with term insurance buyers feeding the main business and whole life policyholders essentially having shares in the company.

The insurance company’s income sources support their investments in class A, stabilized assets, bonds, and loans, avoiding the stock market. They pay out a guaranteed return of 3%, akin to a preferred return, and later, after assessing performance, pay mutual owners a dividend. The passage details the insurance company’s conservative practices, including buying insurance on policies and adhering to strict regulations due to not being a bank. The company’s investment portfolio includes real estate, government debt, and AAA corporate debt, possibly with access to investments beyond average retail investors.

The mechanism of providing a guaranteed rate is suggested to involve trade secrets, and the insurance company reinsures to ensure meeting obligations. Additionally, policy dividends may be paid, but they are not guaranteed.

Have no fear my friend you basically have three options:

- Cash it out and just walk away with the cash that’s in it… In that case, you obviously no longer have a life insurance policy, so the death benefit goes away… Because of the way it was designed, it possibly does not have enough built-in cash value yet for there to be any tax consequence, so you don’t have to work about that…

- Borrow against this policy and use the money that way… You can use it as a properly design self-banking instrument, the downside is that it’s not a great cash building policy so there’s more cost in it than what you’d like to see, and the loan rate may not be really favorable.

- Open a new policy (one that is designed for cash build-up) and do a 1035 exchange into and this time get a policy optimized for banking… The nice thing here is that there would be little cash right upfront to boost the new policy because we are using the old one… The downside is just going through the process of getting a new policy with physical evaluation etc.

Applicants will have to qualify for the policy by completing a medical exam and having the insurance company review their application.

Other requirements may be needed depending on the amount of insurance being applied for.

In general, the cost of insurance is lower on this savings product, and the underwriting requirements are less stringent, making this policy easier to qualify for and also more affordable.

If you are personally not able to qualify for the insurance policy, you could have a healthy individual that you might have an insurable interest in, create the policy (such as your spouse or children).

Unlike retirement accounts (401k, IRA) you do not have to take withdrawals at a certain age/time, you have total control of your funds.

For properly structured whole-life policies there are no surrender charges, which is another benefit for whole life compared to IULs which typically have surrender charges for the first 10-15 years.

begin your journey to financial freedom!

My name is Lane Kawaoka, and I hope my blog/podcast will help families realize the powerful wealth-building effects of real estate so they can spend their time on more important, instead of working long hours and worrying about their financial troubles. There are a lot of successful families with good jobs (teachers / engineers / programmers / finance) yet they struggle to make ends meet financially. It is their kiddos who ultimately get the short end of the stick. Being a Latch-Key Child growing up, both my parents had to work and I was left home alone after school to fiddle with my thumbs.

With Real Estate you are able to grow your wealth exponentially faster than the conventional 401K’s and stock investing, therefore you are able to escape the dogma of working 50+ hour weeks at a job that is unfulfilling. And if you are one of the lucky ones who happen to do what you enjoy… well good for you 😛

Money is not everything but it is important because it gives you the freedom to live life on your terms.

Annoyed by the bogus real estate education programs out there (that take money from people who don’t have it in the first place), I set out to make this free website to help other hard-working professionals, the shrinking middle-class. I hope to dispel the Wall-Street dogma of traditional wealth-building, and offer an alternative to “garbage” investments in the 401K/mutual funds that only make the insiders rich. We help the hard-working middle-class build real asset portfolios, by providing free investing education, podcasts, and networking, plus access to investment opportunities not offered to the general public.

“The true meaning of wealth is having the freedom to do what you want, when you want, and with whom you want.

Building cash flow via real estate is the simple part. The difficult part occurs after you are free financially to find your calling and fulfillment.

But that’s a great problem to have ;)”

excerpt from The One Thing That Changed Everything