book resources

As you move up the Wealth Elevator, I offer free gift resources to support your journey. With each chapter, you can download these specific tools, charts, and online courses to empower your growth.

Introduction

Strategy consultation: I offer you a strategy consultation with me as a gift for reading this book. Sign up via our club form at https://TheWealthElevator.com/club/

Chapter 1 — Road Map

Wealth Elevator overview: For an overview of the floors and approximate net-worth income levels, check out the downloadable resources at https://TheWealthElevator.com/bookresources/ (this page)

Our community: Join our community via the form at https://TheWealthElevator.com/club/

Chapter 2 — The Investment Floors

Basic financial skills: I offer a free e-course to learn basic financial skills. Go to https://TheWealthElevator.com/noob/

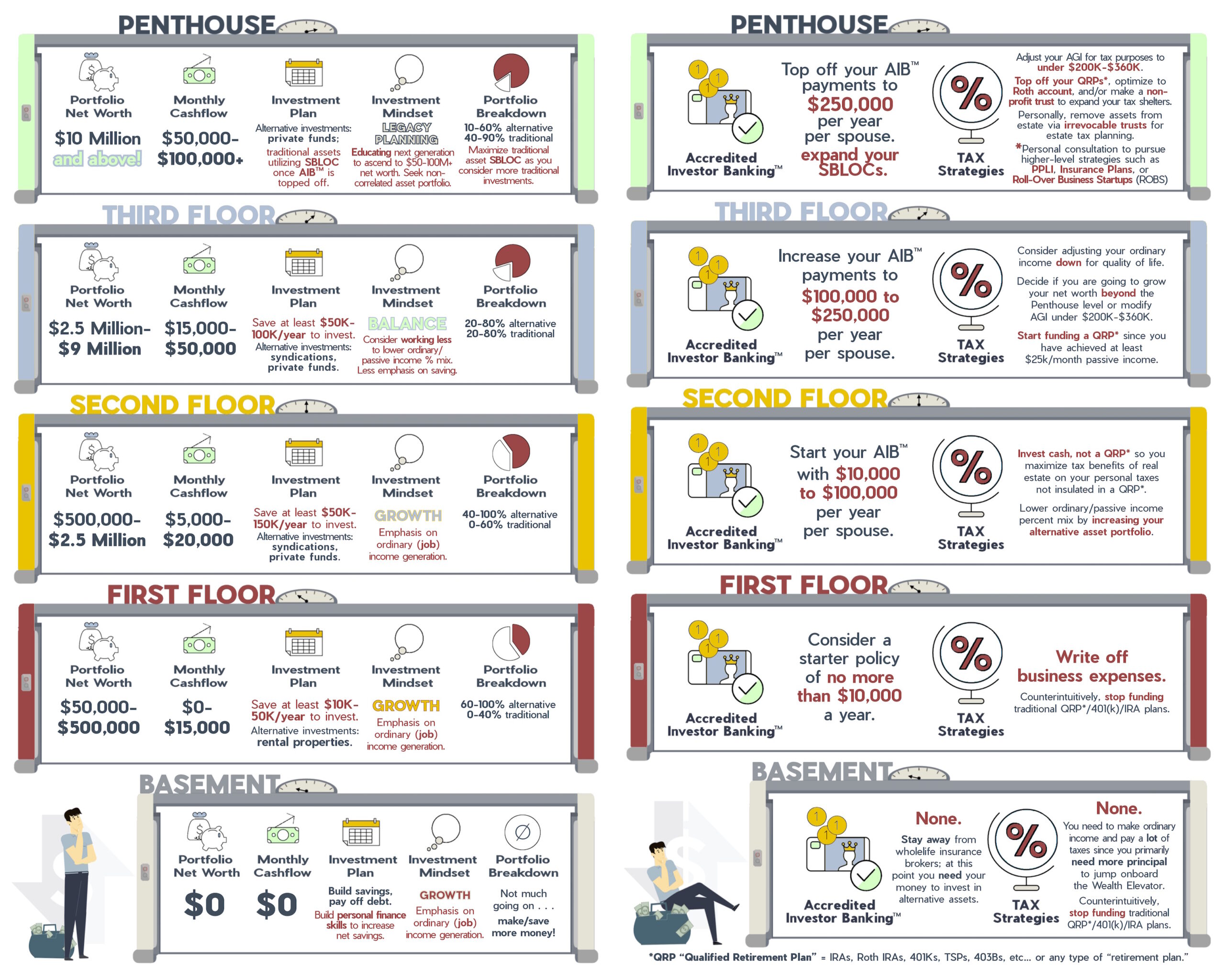

The Wealth Elevator Floors

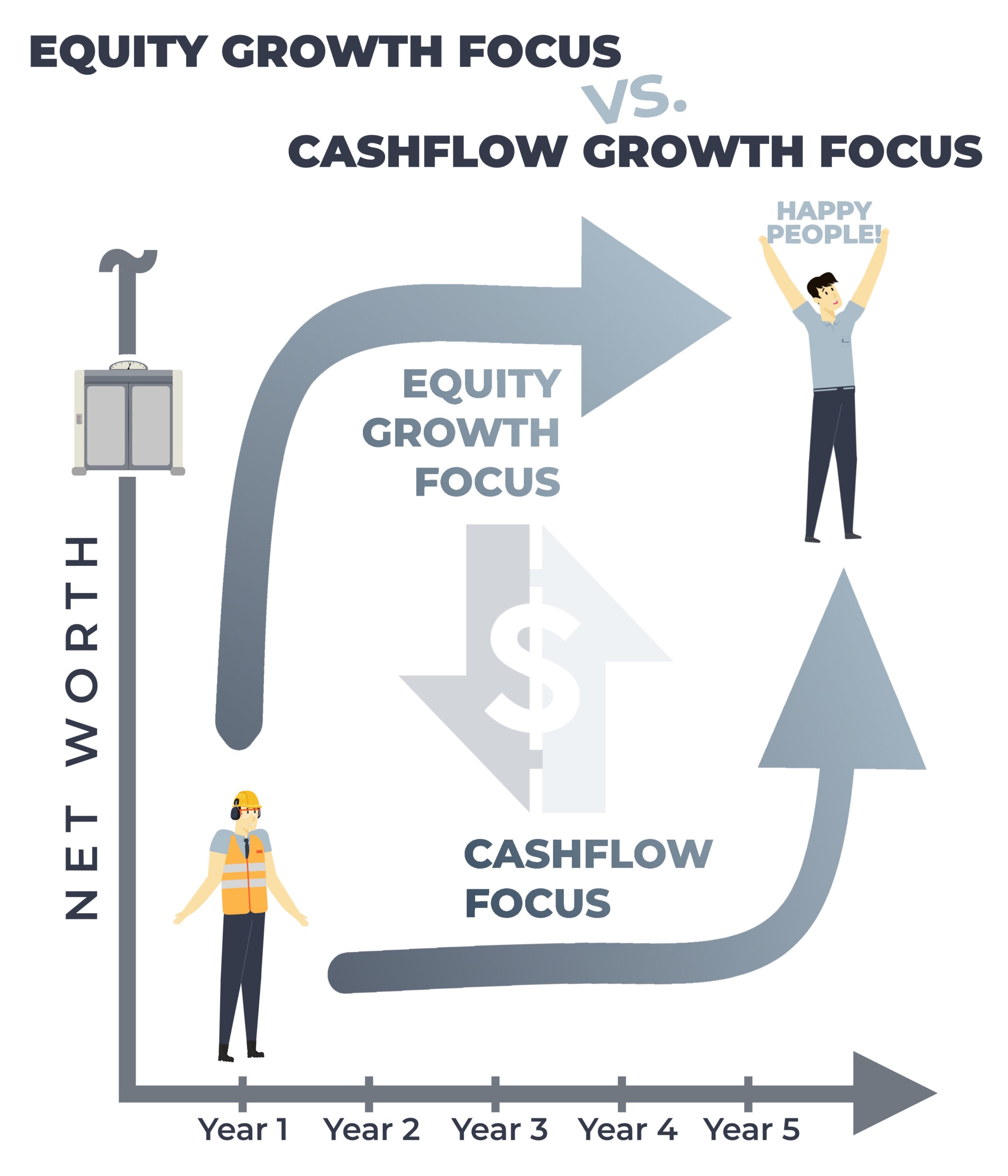

Equity Growth Focus vs Cashflow Growth Focus

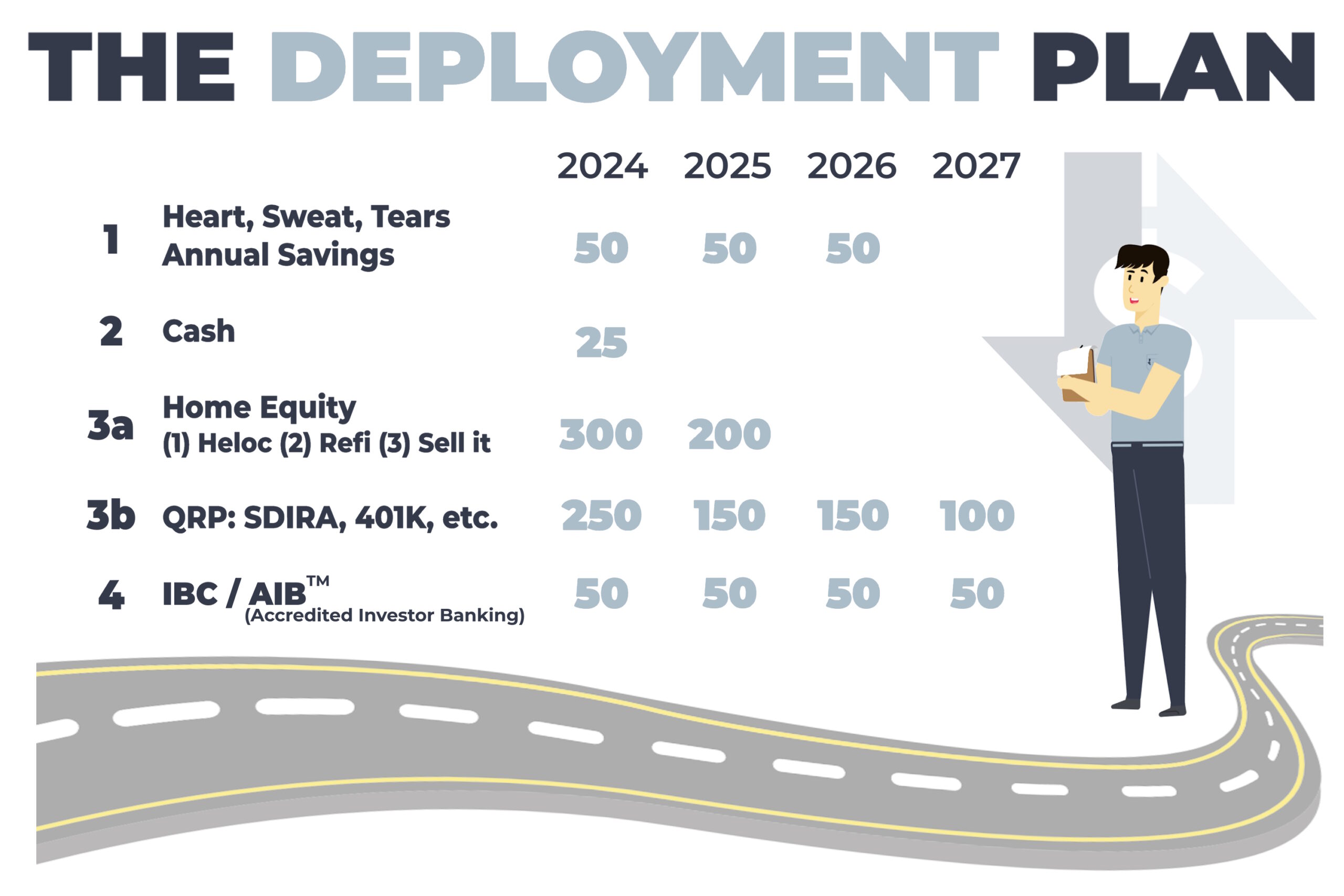

The Deployment Plan

Chapter 3 — Rentals

Stacking investments: If you’re on Floor One, watch the whiteboard exercise I did on stacking investments at https://TheWealthElevator.com/returns/

Turnkey rental properties: For investors interested in remote rental properties, access a valuable e-course at https://TheWealthElevator.com/turnkey/

Property analyzer: To determine whether a rental property will cash-flow profitably, download our free property analyzer at https://TheWealthElevator.com/analyzer/

Return-on-equity chart: Understand how to optimize your return on equity by checking the graph at https://TheWealthElevator.com/roe/

Chapter 4 — Syndications: Roles and Responsibilities

Syndications e-course: I offer a free eight-to-ten-hour e-course on how to evaluate syndication deals. Sign up at https://TheWealthElevator.com/syndication/

Chapter 5 — Syndications: Building Partnerships

Syndications e-course: For a guide to doing due diligence on deals and general partners, go to https://TheWealthElevator.com/syndication/

Operator testimonials: Questionable operators can easily create fake testimonials. See our examples of real testimonials at https://TheWealthElevator.com/testimonials/

Chapter 6 — Private Funds

Net savings strategy consultation: I’m happy to jump on a call to explore how you can plan your net savings. Join me via the form at https://TheWealthElevator.com/club/

Chapter 7 — Taxes, PALs, and QRPs

Your mini-pension strategy: Join our hui for a complimentary coaching session on your pension at https://TheWealthElevator.com/club/

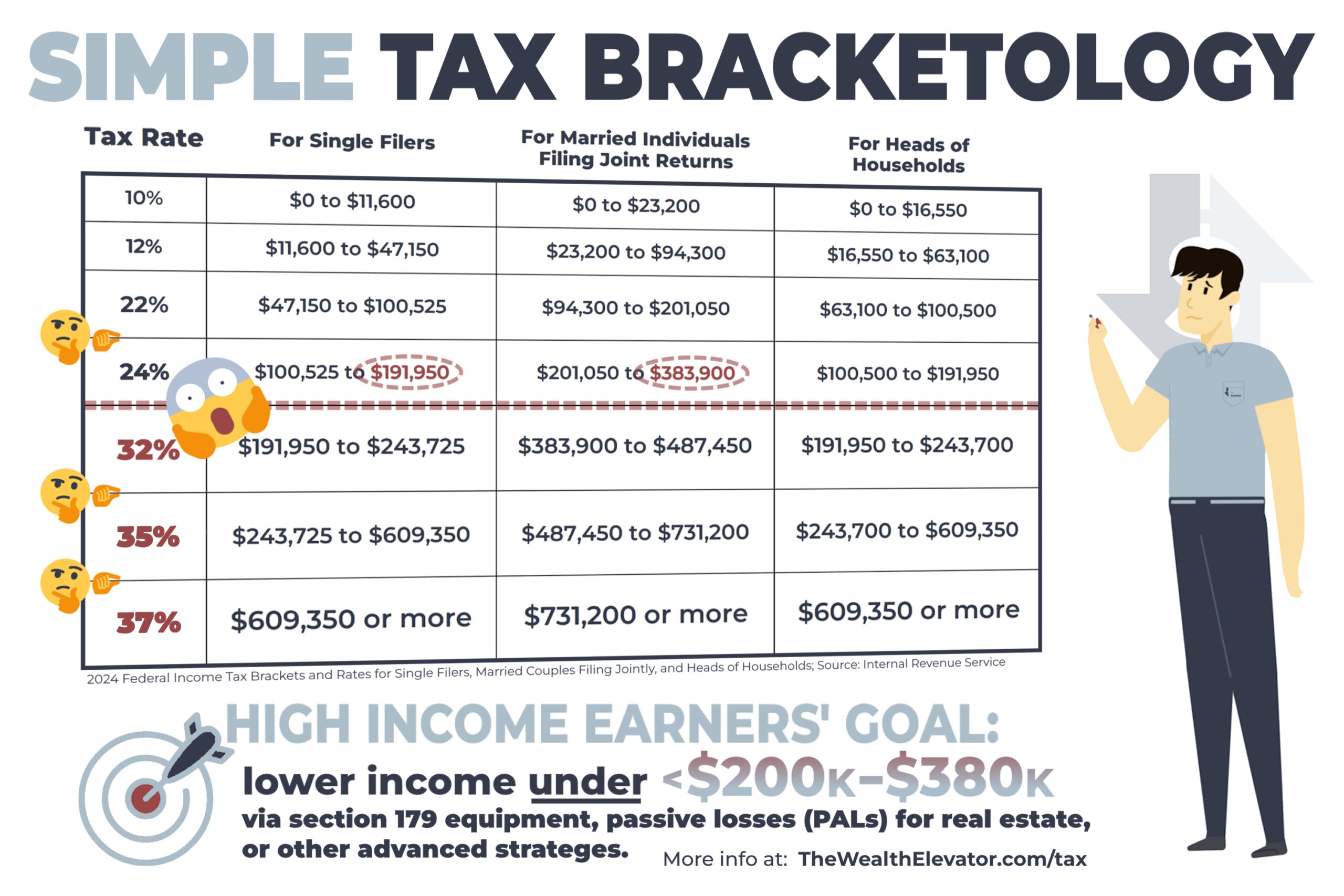

Simple Tax Bracketology

Chapter 8 — Tax Mitigation and Asset Protection Strategies

Cost segregation chart: We can show you how to calculate your income and costs for greatest tax savings. See our free tool at https://TheWealthElevator.com/diycostseg/

Referrals to CPA teams for tax strategies: Join our club at https://TheWealthElevator.com/club/ and send us an email.

Ordinary vs Passive Income

Chapter 9 — Accredited Investor Banking

Blueprint for Accredited Investment Bank (AIB): Contact our team at bank@theWealthElevator.com

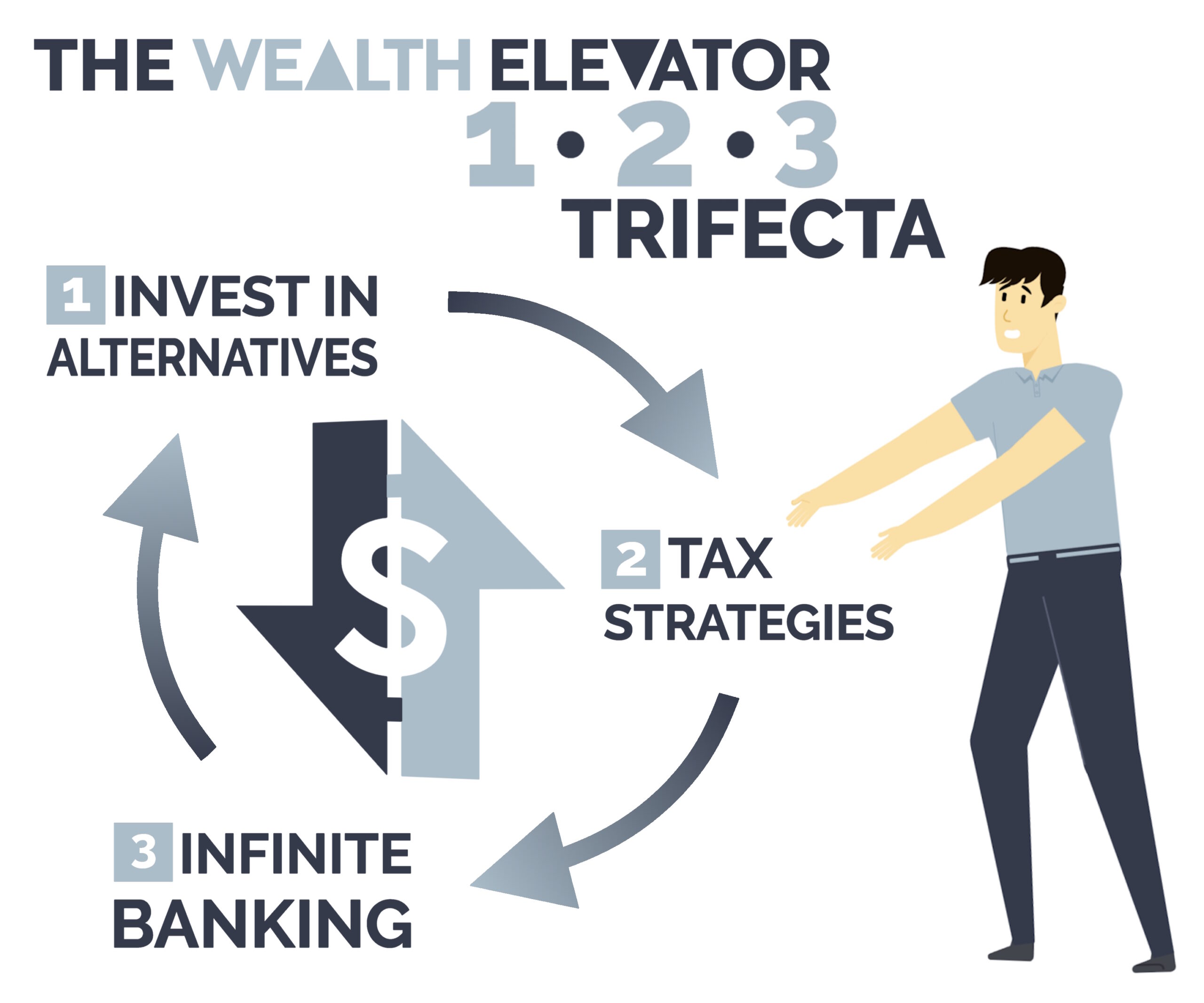

The Wealth Elevator Trifecta

Chapter 10 — Socializing Your Family Office

My fail story: You can read the detailed saga of how I lost money with a bad syndication operator at https://TheWealthElevator.com/fail/

Meet other investors on your floor: If you are not yet interacting with others at your level, reach out to team@theWealthElevator.com for a free syndication LP e-course. It will empower you with the prerequisite information to interact with other purely passive accredited investors.

Turnkey rentals: For a free e-course on remote rental properties, go to https://theWealthElevator.com/turnkey/

Chapter 11 — The Penthouse: A $10 Million Portfolio and Beyond

Resource gifts for saving: For radical ideas on how to save money for investing, visit https://TheWealthElevator.com/cheapo/

Best strategies for you: Our events offer an excellent opportunity to learn more about our wealth strategies and meet other investors in our community. Visit https://TheWealthElevator.com/events/

Chapter 12 — The Penthouse and Rooftop: Tax Strategies

Tax strategies: I offer a gift conversation about which tax strategies will best support your financial goals. Join me via the form at https://TheWealthElevator.com/club/

Chapter 13 — Close

Gift consultation: I’m happy to offer a gift conversation about how to apply the Wealth Elevator concepts to your investing journey. Join me via the form at https://TheWealthElevator.com/club/

begin your journey to financial freedom!

My name is Lane Kawaoka, and I hope my blog/podcast will help families realize the powerful wealth-building effects of real estate so they can spend their time on more important, instead of working long hours and worrying about their financial troubles. There are a lot of successful families with good jobs (teachers / engineers / programmers / finance) yet they struggle to make ends meet financially. It is their kiddos who ultimately get the short end of the stick. Being a Latch-Key Child growing up, both my parents had to work and I was left home alone after school to fiddle with my thumbs.

With Real Estate you are able to grow your wealth exponentially faster than the conventional 401K’s and stock investing, therefore you are able to escape the dogma of working 50+ hour weeks at a job that is unfulfilling. And if you are one of the lucky ones who happen to do what you enjoy… well good for you 😛

Money is not everything but it is important because it gives you the freedom to live life on your terms.

Annoyed by the bogus real estate education programs out there (that take money from people who don’t have it in the first place), I set out to make this free website to help other hard-working professionals, the shrinking middle-class. I hope to dispel the Wall-Street dogma of traditional wealth-building, and offer an alternative to “garbage” investments in the 401K/mutual funds that only make the insiders rich. We help the hard-working middle-class build real asset portfolios, by providing free investing education, podcasts, and networking, plus access to investment opportunities not offered to the general public.

“The true meaning of wealth is having the freedom to do what you want, when you want, and with whom you want.

Building cash flow via real estate is the simple part. The difficult part occurs after you are free financially to find your calling and fulfillment.

But that’s a great problem to have ;)”

excerpt from The One Thing That Changed Everything